About GroW

Leveraging women’s knowledge and networks for greening of finance

The Greening of Finance by Women (GroW) Network seeks to advance the role of and integrate women in the green and climate finance landscape as a part of the Green Indian Financial System (GIFS) Initiative. The network is key to ensuring that the value of women experts in the field is recognized and will help reinforce and capitalize on the gender axis of the sector.

Core Outcomes

Core

Outcomes

Enhance

- Enhance the visibility of women professionals in green and climate finance

Enable

- Enable collaboration among varied stakeholders working in green and climate finance

Facilitate

- Facilitate targeted knowledge enhancement for women professionals in green and climate finance

Why do we need a Network?

Why do we

need a

Network?

Hear from experts in the field on the role women play in greening the financial systems, and the need for setting up an exclusive platform:

Steering Committee Members

Core

Members

Riya Saxena

Senior Associate, RMI India

Riya Saxena

Riya Saxena is a senior associate with the Rocky Mountain Institute (RMI) India team. Her work focuses on catalyzing climate finance to meet India’s 2070 net zero target. Prior to RMI India, Riya worked with the United Nations Development Programme (UNDP) on sustainable finance policy advocacy and design of SDG-aligned financial instruments. Previously, she worked with an impact investment platform, Asha Impact, to invest in for-profit early-stage social enterprises.

Namita Vikas

Founder & Managing Director, auctusESG LLP

Namita Vikas

Namita Vikas is a senior business leader with over 30 years of diverse global experience in sustainable finance, ESG, and climate transition across banking and technology. She is the Founder and Managing Director of auctusESG LLP, serving on the global advisory board of Climate Bonds Initiative, UK, the Finance Industry Advisory Board of the International Energy Agency, and Digital Green, USA and so on.

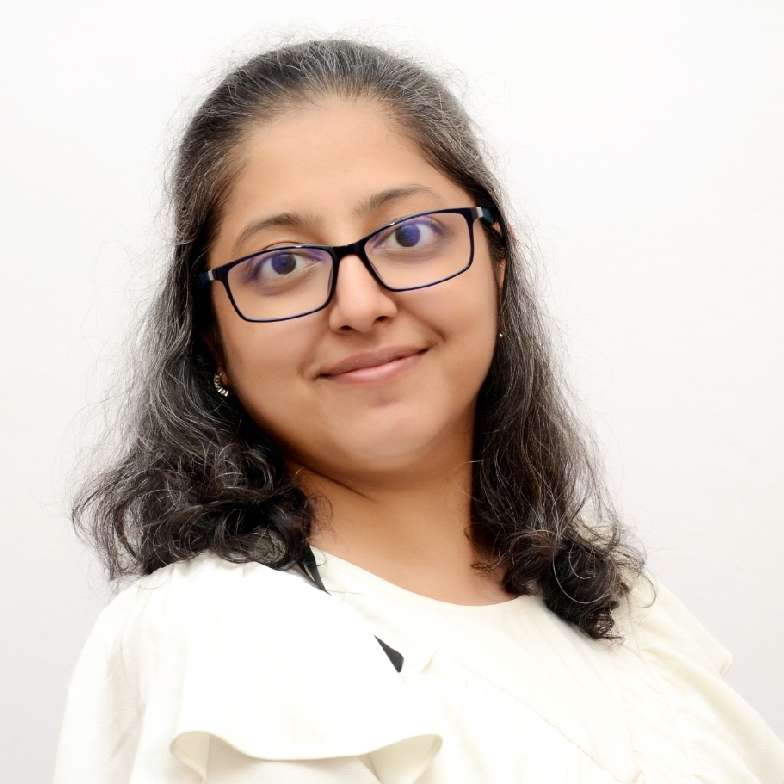

Neha Khanna

Senior Manager, Climate Policy Initiative

Neha Khanna

Neha brings 13 years of experience which is backed by an undergraduate degree in Engineering and a Master of Business Administration. Her experience spans across technology, risk management, strategy consulting, development consulting, climate risk, green and sustainable finance with a strong focus on the financial sector. Recently, her work has expanded to include enabling capital investments in climate-oriented businesses, reflecting her increased focus on solutions for climate change.

Roopa Satish

Country Head, Sustainable Banking & CSR, IndusInd Bank

Roopa Satish

An alumnus of IIM Lucknow, Roopa Satish is a career banker with over 30 years of experience in domestic and multinational banks. Roopa joined IndusInd bank in 2008 as a part of the new Management team from ABN Amro, with a mandate to revive and turnaround IndusInd Bank. She set up and scaled the Corporate and the Investment Banking Groups over the years. An avid green thinker, Roopa currently is the Country Head Sustainable Banking at IndusInd bank and is credited with setting up the ESG Risk Assessment Framework of the Bank. The Unit is responsible for all Sustainability linked initiatives of the bank such as business development in SDG linked sectors, MSME strategy, Supporting Women Entrepreneurs, New ESG Product development, ESG Risk Assessment, and Carbon Emission reduction strategies for the bank. She also heads CSR and the Portfolio Management & Decision Science Units. She is currently on the Board of IIM Lucknow and IIM Lucknow Incubator.

Seema Arora

Deputy Director General, Confederation of Indian Industry

Seema Arora

Seema Arora pioneered the creation of services on Sustainable Development within CII. Her journey with CII began with engaging Indian Industry towards the run up to the Earth Summit in 1992. Seema Arora works on designing innovative products and frameworks to build the business case for industry to invest in Sustainability and CSR. She works with Industry, Government and Community based organizations to develop policy instruments, curate collaborative initiatives across sectors and stakeholders and develop innovative voluntary approaches to Sustainable Development. Her portfolios in CII include the Centre of Excellence for Sustainable Development, Development Initiatives, CII Foundation, and Indian Women Network. Seema Arora has a bachelor’s degree in Engineering from Delhi University. She is a part of the Asian Impact Leaders Network Co-created by AVPN & Rockefeller Foundation. She has 30+ years of experience in the field of Sustainable Development.

Madhu Tyagi

Director, Confederation of Women Entrepreneurs (COWE) India

Madhu Tyagi

Madhu Tyagi is currently the Director of BOD and National President, COWE India, spearheading the initiative to empower women through entrepreneurship. She has previously worked as the Chairperson for Standup India (SUI) to create awareness and implementation of the scheme by aspirant women entrepreneurs. Ms. Tyagi started her journey as Director at SVS Refcomp Private Limited as a first generation entrepreneur. She has also served as Elected Representative in Industrial Area Local Authority (IALA) in Telangana and brought initiative for Greenery Conservation in Industrial Area of Jeedimetla, Telangana by introducing the garbage cart for garbage collection and not the scrap generated from industries so the garbage is not skewed on the roads.

Neha Kumar

Head, South Asia Programme, Climate Bonds Initiative

Neha Kumar

Neha Kumar is the Head, South Asia Programme, Climate Bonds Initiative. She drives policy, strategy and partner programmes to scale up the green bonds market and sustainable financial ecosystem. She has also served on the Ministry of Finance Working Group on Sustainable Finance Taxonomy development, and international ESG standard setting bodies. Her efforts are targeted at building policy mechanisms and market infrastructure, and mainstreaming standards needed to accelerate financing for green, just and resilient transition, creating capacities across sovereign, sub sovereign, financial and non-financial entities on climate risks and transition finance. She has nineteen years of experience in public policy, regulation and industry action in India on sustainability, responsible financing and environmental and political risks to national and international investments. She is also a Senior Research Associate with the ODI.

Mamta Kumari

AGM, Small Industries Development Bank of India (SIDBI)

Mamta Kumari

Ms. Mamta Kumari, a development banker, is presently contributing to Cluster Development Vertical of the Bank. Joining SIDBI in March 2007, she has around 15 years of experience in various domains of Financing and Development of MSMEs. Ms. Mamta holds master’s degree in science.

Ms. Mamta has extensive field level experience, both in finance and development. While presently she is handling SIDBI Cluster Development Fund portfolio wherein project-based funding (MSME infrastructure projects) is being done to State Governments, previously, she has also worked in microfinance space as well as funding MSMEs under direct credit operations of the Bank. In addition, she has been part of team engaged with managing several innovative initiatives including Standupmitra (a virtual eco system for Standup India), Udyamimitra portal (which today also powers PMSVANidhi, AHIDF, PLI schemes on plug and play model), EU Switch Asia Project (sustainable production in clusters, Bamboo clusters in 7 states). She is also taking care of cluster development engagement on soft infrastructure side in 10+ clusters, pan India.

Ms. Mamta has been representing SIDBI in several forums at regional & national level through various initiatives with COWE (for women entrepreneurs), DICCI (for SC/ST entrepreneurs).

Sowmya Suryanarayanan

Director - Impact & ESG at Aavishkaar Capital

Sowmya Suryanarayanan

Sowmya heads Impact and ESG function at Aavishkaar Capital, a global pioneer Impact Fund Manager that invests in impact enterprises in India, South and Southeast Asia and East Africa. She is responsible for delivering significant Impact, Gender & ESG value across Aavishkaar’s various Impact Funds and the portfolio companies. She is a social development and sustainability professional with 16 plus years of experience in the field of inclusive business model assessments across financial inclusion, sustainable agri, clean energy, education and health sectors.

Camille Severac

Deputy Head of New Delhi Office, AFD - Agence Française de Développement

Camille Severac

Camille Severac is the Deputy Country Director of AFD in India.

She has a financial and private sector development background. After beginning her career working in private banks, she joined the AFD Group and has worked for more than 15 years on public and private sector projects contributing to the fight against climate change, financial inclusion or more sustainable banking systems.

Kruthika Jerome

Program Manager (Clean Energy Finance), Shakti Sustainable Energy Foundation

Kruthika Jerome

Kruthika manages Shakti’s Clean Energy Finance Programme. A climate finance professional, Kruthika has experience in financial services and public policy. Prior to joining Shakti in October 2021, she has worked with Goldman Sachs as an Associate, where she partnered with various stakeholders on derivative risk management. She also worked with Finance Ideas (Netherlands) as a Sustainable Investment Consultant in the past. Kruthika has master’s in public policy from Maastricht University and UNU Merit, and B Tech in Electronics and Communication Engineering from Manipal Institute of Technology.

Nupur Garg

Founder, WinPE Development Forum

Ragini Bajaj Chaudhary

Director – Investments, Caspian

Ragini Bajaj Chaudhary

Ragini Bajaj Chaudhary, Executive Director Caspian Debt, is a development finance professional with more than 20 years of experience in microfinance, impact investment and mainstreaming gender in financing. She leads the finance and fund-raising team at Caspian Debt which provides customised debt to first generation entrepreneurs building for a better World. Prior to Caspian, Ragini served as a CEO of GMC India where she led programs of incubating accelerating and investing in ed-tech enterprises. She is passionate about improving funding outcomes for women entrepreneurs in general and climate entrepreneurs. She serves on the Gender Expert Committee of RBI Innovation Hub, ANDE India Steering Committee, Board of Trustee for Voice for Girls and Advisory Board of IRMA ISEED Foundation.

Anjali Bansal

Founding Partner, Avaana Capital

Anjali Bansal

Anjali Bansal is the Founding Partner of Avaana Capital which manages Avaana Climate and Sustainability Fund, investing in technology and innovation-led start-ups catalysing climate solutions and sustainability and delivering exponential returns. Previously, Anjali has been the Non-Executive Chairperson of Dena Bank, appointed by the Government of India to steer the resolution of the stressed bank, eventually leading to a merger with the Bank of Baroda. Prior to that, Anjali was a Global Partner and Managing Director with TPG Growth PE, responsible for India, SE Asia, Africa and the Middle East. She started her career as a strategy consultant with McKinsey and Co. in New York.

Anjali has invested in and mentored various successful start-ups including Delhivery, Urban Company, Darwinbox, Nykaa, Lenskart and Coverstack. She also serves as an independent non-executive director on several leading boards including Tata Power (Chair, Sustainability Committee), Nestle (Member, CSR and Sustainability Committee), and Piramal Enterprises, and chairs the “Climate Special Interest Group” within Indian Venture Capital Association. She has previously chaired the India board of Women’s World Banking, a leading global livelihood-promoting institution, been a board member at GSK Pharma, Siemens, Voltas and Bata.

Anjali is a Member of the Niti Aayog Evolution Review Committee, India’s premier policy think tank chaired by the Hon’ble Prime Minister. She has been appointed on the Expert Advisory Committee for the Start Up India Seed Fund Scheme announced by the Honourable Prime Minister.

She is also a member of the Advisory Council for the Open Network for Digital Commerce (ONDC), the world’s first open access infrastructure for digital commerce and serves on the CII National Committee on Corporate Governance. She has previously served as President of the Bombay Chamber of Commerce, and has co-founded and chaired the FICCI Center for Corporate Governance program for Women on Corporate Boards. She is a member of the Young Presidents’ Organization and a charter member of TiE. She has been listed as one of the “Most Powerful Women in Indian Business” by India’s leading publications, Business Today, and by Fortune India.

Initiated by

The Green Indian Financial System (GIFS)

Initiative seeks to facilitate dialogues and discussions on greening the Indian financial system between all stakeholders, as well as to catalyse existing initiatives and identify priority areas for Indias climate finance actors.

Powered by

Intellecap, a part of the Aavishkaar Group, is a pioneer in building enabling ecosystems and channeling capital to create and nurture a sustainable and equitable society. Founded in 2002, Intellecap works across the Global South, with physical presence in India and Africa. It provides a broad range of Consulting, Research and Investment Banking Services across critical sectors, inlcuding Agriculture, Energy & Climate Solutions, Financial Services, Gender & Livelihoods, Health and WaSH, and has delivered over 500+ global engagements across 40+ countries and syndicated investments of over USD 1.1 billion capital.